The OECD recognizes Spain as one of the most willing countries to promote RDI activities. Investments in knowledge transfer and job creation also benefit from special tax treatment.

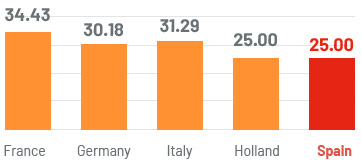

Moderate corporate tax

moderate

Spain’s corporate tax rate within the Eurozone is moderate (25%) and incentives and tax exemptions can reduce the effective tax rate to around 20%.

Corporate tax rate

Tax incentives to promote

foreign investment and entrepreneurship

Tax incentives for RDI

Up to 42% corporate income tax credit for RDI activities.

In case of insufficient income tax liability, Spanish regulations allow unused tax credits to be carried forward to RDI investments.

Spain has one of the most advantageous "patent box" regimes in the EU: Up favourable to a 60% exemption of net income resulting from the use of certain intangible assets transferred or licensed to another entity (patents, models, designs, formulas or projects).

There are a large number of aid and incentive programs from Spanish and European administrations, with an emphasis on research, development and technology and innovation (RDTI).

Tax adjustments

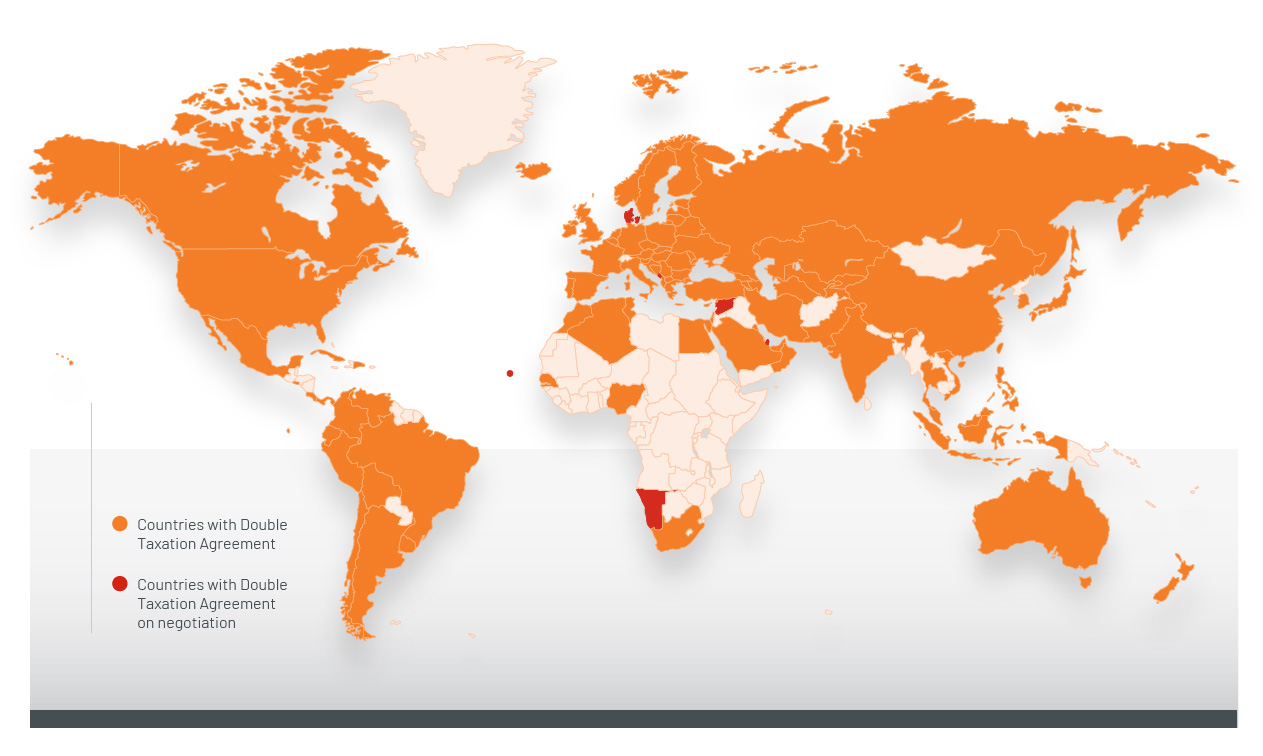

for international companies

Spain is a platform for international business and investment opportunities. The Spanish tax system is advantageous to international companies that can benefit from the 94 double taxation agreements signed by Spain and currently in force, particularly with Latin American countries.

The “participation exemption” scheme benefits international companies. Dividends and capital gains obtained from the transfer of shares of non- resident subsidiaries in Spain are exempt from taxation.

Spain has a special tax regime for holding companies ("Spanish Holding Companies"-ETVE) that allows dividends and capital gains from the transfer of shares from subsidiaries to be exempt from taxation.

Tax regime

highly attractive for foreign workers

The fixed rate of personal income tax for the first six years is 24% on all income up to €600,000, and 47% on income over €600,000 if the expatriate has not lived in Spain for the ten fiscal periods prior to relocating to the country, in which case, returns from savings earned abroad are not taxed in Spain.

Tax neutrality

for business restructuring

There is a tax neutrality regime in Spain for business restructuring operations so that mergers, demergers or any other structural reorganization can be done without tax-related penalties.