“Spain, world-class creative hub”

The audiovisual industry plays a key role in the Spanish economy. Spain ranks sixth in the European Union in the number of titles produced (behind Germany, France, the United Kingdom, Holland and Italy) and fifth in production hours (behind Germany, the United Kingdom, France and Italy). According to data from the European Audiovisual Observatory, Spain is amongst the five main countries exporting pay-per-view films (TVOD or PPV), along with the United Kingdom, Germany, France and Italy.

For the Spanish Government, the industry is strategic due to its global scope, ability to create employment and its potential for modernisation with digitisation. As a result, it approved the “Spain, Audiovisual Hub of Europe” plan in March 2021, with more than 1.6 billion euros of public investment until 2025, and with the aim of making Spain a leading country for audiovisual production in the digital age, a magnet for investment and international talent, and with an enhanced ecosystem for exporting and competing on international markets.

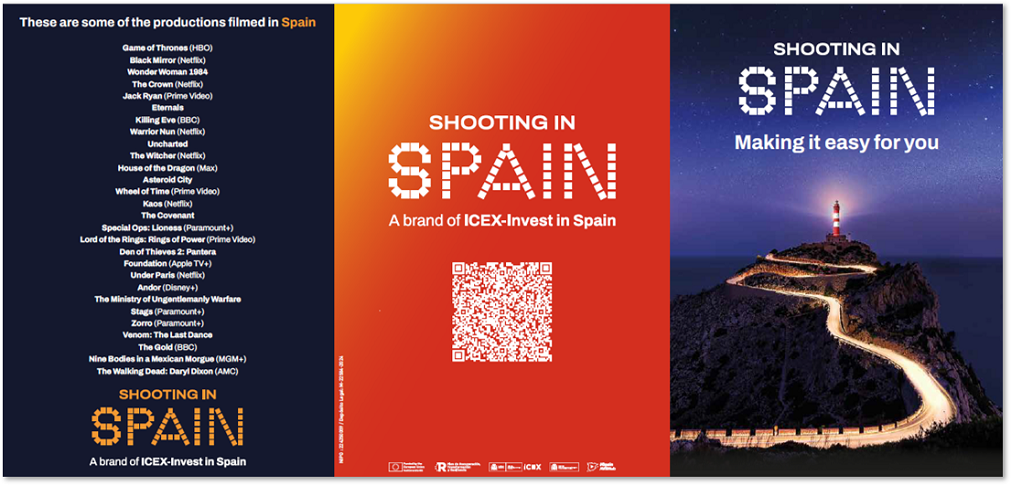

Its team of professionals, cutting-edge solutions, diverse locations, and tax incentives draw an increasing number of international productions to our country, which along with a large number of domestic productions, are attracting the attention of international platforms.

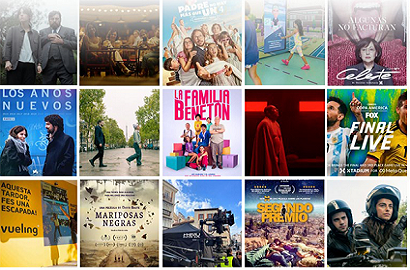

There has been an increase in both quantity and quality. The industry has managed to adapt to the times and develop new viewing models. Digital platforms are the main drivers of this growth.

More immediately relevant content is also offered. The business model is increasingly supported by the production of fiction series. According to the PWC study, The opportunity of fiction content in Spain, the potential market for fiction series productions will generate revenues of almost 4.3 billion euros, contribute 811.9 million to the GDP, produce as many as 72 series, create 18,443 jobs (13,944 direct) and give rise to tax revenues of almost 264 million euros.

There is no doubt that Spain has become a hub for international productions. The filming of blockbusters in our country such as HBO’s Game of Thrones, and the success of La Casa de Papel on Netflix (which has in fact set up a headquarters in Madrid) are only two examples of the importance of the Spanish audiovisual industry in the world.

Increased investment and TV fiction production in Spain

In addition to Spanish-speaking content, another opportunity is the production of international content in Spain, potentially channeled via the development of a production hub for international content in the country.

- Talent, with first-rate producers, creators, directors, etc.

- Substantial technical resources for film and other related industries.

- Low cost of production in Spain compared to other countries.

- Maturity of the local industry, with experience in making first-rate international products.

- Global positioning of Spanish content with international hits such as La Casa de Papel and Élite.