Spain's growing attractiveness for renewable energy investment

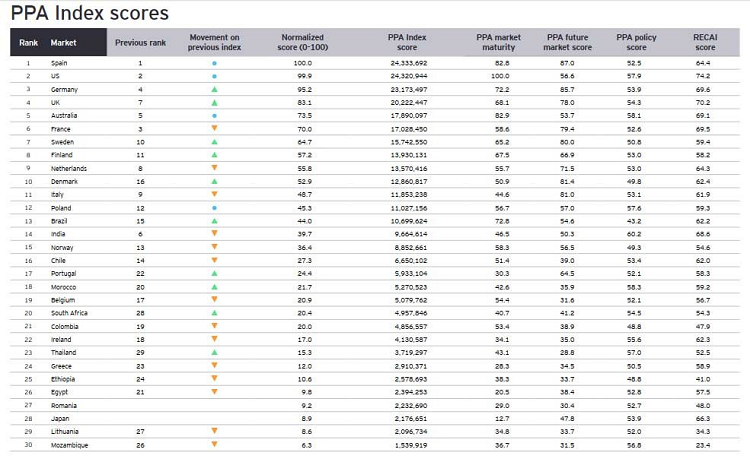

Ranked ninth in EY's semi-annual report, and first when it comes to long-term power purchase agreements

Spain has moved up one place in the ranking of the most attractive countries for investment in renewable energies, and is now ninth in the world. This is one of the most significant details from the biannual Renewable Energy Country Attractiveness Index (RECAI) report, prepared by EY and now in its 59th edition. The podium is occupied by the United States, China and the United Kingdom.

Spain had been in tenth position since 2020, when it returned to the top ten after having dropped out in 2011. Its rise to ninth place comes at a time of heightened geopolitical tension, as the report underlines, and unprecedented volatility in the natural gas market, with the renewables sector now at a turning point.

Number one in terms of purchase agreements

The area in which Spain is currently unrivalled is renewable power purchase agreements (PPAs). EY ranks Spain above the US and Germany when assessing the attractiveness of developing offsite PPAs. It mainly assesses the number and volume of transactions, as well as prospects and prices.

Long-term renewable power purchase agreements between producers and consumers contribute to the stability of projects. This is because the developer can measure the profitability and risk of the investment by using reliable data, as well as having more access to financing.

PPAs have improved their attractiveness in the face of energy market volatility. With rising electricity prices and low liquidity in electricity futures markets, PPAs allow consumers to lock in the prices they will pay for energy in the medium to long term.

One of the pillars of Spain’s attractiveness

The partner responsible for the energy sector at EY, Agustín Rico, says that Spain's leadership in the PPA market "is one of the pillars for the increasing attractiveness of investment in renewable energy projects in our country, due to this being the way to finance these projects and achieve strategic objectives for offtakers (buyers), which increasingly leads to more complex and differentiated power purchase agreement models".

Antonio Hernández, the partner in charge of regulated sectors and economic analysis at EY, added, "PPAs are playing a very important role in the current environment, allowing companies to hedge against volatility and significant price increases in the electricity market, as well as improving compliance with their decarbonisation and sustainability goals by purchasing green PPAs.”

Energy diversification

EY's report measures the investment attractiveness of national renewable energy markets and their ability to deploy infrastructure, as well as the most important trends, barriers and challenges in the sector. The war in Ukraine and other international factors have caused many of these markets to move towards energy diversification in order to reduce their dependence on gas.

This explains changes in the rankings, such as in the case of Spain and the UK, which has reached the podium for the first time after falling as low as eighth in 2019. The emergence of Latin America is also significant, and which EY describes as the sleeping giant. A giant because of its abundant sunshine, vast hydroelectric potential and favourable locations for onshore wind energy. And sleeping, because until now it had not figured much in the rankings, despite the fact that Brazil is the world leader in hydroelectric production. According to the report, Chile, Argentina and Mexico also have great potential if they can overcome obstacles like political uncertainty and financial complexities.

Stability and energy security

On this subject, Rico explained that the response to geopolitical tensions "is causing various countries, including Spain, to work to reorient their supply strategy in an environment where emerging green technologies are gradually moving from being a niche market to becoming mainstream". Therefore, he added, "countries are looking for stability and energy security, so renewables could be at a turning point, and investment for developing technologies and infrastructure will be key to expanding their weight in the energy mix".

The emergence of new technologies

Rising energy prices are driving the development of new technologies such as wind and floating solar power. Offshore wind can provide access to stronger and more consistent winds without the need to anchor turbines to the seabed, an option exploited in northern Europe but unfeasible in the south, where water depths make this option too expensive.

According to the EY report, one factor in favour of the development of floating offshore wind is that 80% of the potential in Europe and 58% in the US is in areas deeper than 60 metres. And another factor is the ability of wind energy in turn to produce another rising energy source, green hydrogen.

As for the development of floating solar panels, the main factor in favour of this technology is the growing opposition to its development on land. After years of development, this energy source has entered into direct competition with agriculture for production space.

Photo: EY