Hotel investment continued to grow in 2022 thanks to foreign capital

A total of 2.368 billion euros, 72% of an overall figure of 3.279 billion euros, came from abroad

Hotel investment in Spain grew again in 2022, approaching the figures seen in 2017 and 2018, years that have marked the ceiling for these transactions to date. According to the Hotel Investment Report in Spain published by Colliers, this figure of 3.279 billion euros is the third highest ever investment in the Spanish hotel market. This was the second consecutive year that the figure has topped 3 billion euros, with an increase of 3.1% compared to 2021, when it reached 3.1 billion euros.

133 operating hotels were sold last year, with a total of 17,754 rooms, as well as 30 properties for conversion into hotels and land for hotel use. The figure is slightly higher than that recorded in 2021, when 127 hotels were sold, but with fewer rooms, 19,043, giving an idea of the size of the assets.

Foreign investment

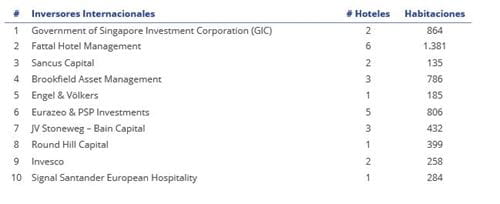

Just as it has been doing since 2015, foreign capital continues to dominate these transactions, to the extent that 72% of all capital invested in the sector in 2022 was from foreign sources. Investors from Singaporean sovereign wealth fund GIC, investment vehicle Sancus Capital, Israeli group Fattal, owner of the Leonardo chain, Brookfield, Engel & Völkers and Eurazeo & PSP Investments paid out a total of 2.368 billion euros.

Among the most significant transactions in 2022 was the arrival in Spain of new institutional funds like Cerberus, which acquired the Ferrer Hotels chain; Swiss manager Pictet, which purchased Kympton Aysla Mallorca and the Hotel Expo Valencia; and US fund Fortress, which bought Sareb’s assets.

Holiday properties overtake urban hotels

Regarding types of assets, the holiday sector, with 58% of the total, regained the leadership it won in 2016 but lost in 2021. This occurred despite significant transactions in the urban segment in Madrid and Barcelona. Madrid, with a 34% share and 803 million euros, was at the forefront of this segment, compared to the Balearic Islands, which led the holiday sector, with 33 transactions worth 913 million euros. Seven transactions carried out in Madrid were concluded for over 50 million euros.

Major portfolio transactions swelled the figures in 2022, with 14 portfolios together accounting for 41% of investment, with a volume of 1.352 billion euros. They add up to 50 hotels and 7,691 rooms. The fact that more than a third of total investment was in five-star and luxury hotels has increased the average price per room to 168,800 euros, which is 7% more than in 2021 and a new record.

One million euros per room

Among the operations pushing up this figure were the sales of Bless Hotel Madrid and the Rosewood Villa Magna, also in the capital city, which amounted to over a million euros per room. Another two hotels in Madrid and one in the Balearic Islands, the 7Pines Ibiza Resort, the Único Hotel Madrid and the Iberostar Las Letras Gran Vía, were sold for over 500,000 euros per room.

According to the Managing Director of the Hotels Department at Colliers, Laura Hernando, “In a market marked by uncertainty, investors prefer to invest their liquidity in prime assets, driving up the average prices of hotels”. Regarding the new year, Hernando explained that it is starting off “with a good inertia of transactions in the pipeline worth over 2 billion euros”.

This figure, coupled with the resurgence of demand from tourists, makes her optimistic “regarding the prospects for the new year, although uncertainty will continue for the foreseeable future”. As far as the inflationary crisis and rapid interest rate hikes to control this are concerned, Hernando believes that many investors expect this to stabilise in the short term. “Meanwhile, investors with more liquidity and buying pressure will focus on prime assets, due to their high liquidity and lower sensitivity to uncertainty, and on obsolete assets with high CapEx needs, depending on their core or value-added profile respectively”, she concluded.

Photo: Colliers